But contrary to other loans, the payments you make on credit score-builder loans are put into a dedicated cost savings account, and the money is returned for you at the conclusion of your repayment time period — minus any desire or expenses.

It enables potential buyers to choose a private financial loan out and place it in the direction of their deposit given that all of it expert services. In addition they lend to those with bad credit history and also to self-employed those with no money accounts.

Are not able to price Jeff plus the team at iLender very more than enough! Jeff, Marilyn, Mo and Bruce all went the extra mile for us on more than one occasion and we are now happily settled within our new dwelling.

Thank you very much Jeff for the assistance to kind out our property finance loan inside a confined time schedule. Despite the fact that we had been having a lot of tension, you've got performed it effortless speaking on each day basis and peace of mind; ofcourse thats what we would have liked and thats what we received. Many thanks all over again, Vijay + family members

Preset private loansVariable private loansNew or utilized motor vehicle loansDebt consolidation loansHome improvement loansBest personalized loansLow interest loansStudent loansMedical loansWedding loansHoliday loansView all personalized financial loans

Jeff is wonderful! Thank you for Doing work so challenging to get us seriously terrific offer.With no Jeff I,m undecided we'd be able to own our first dwelling.Many thanks Jeff A++

Every why not try these out lender has its own ways of analyzing borrowers and determining rates, so it’s a smart idea to Examine prequalified charges from multiple lender. Normally, the shorter the loan time period, the decreased the interest amount supplied by most lenders; and the greater your credit score score and credit history report, the better the interest price you are able to qualify for. Securing reduced fascination costs aids you preserve around the life of a mortgage.

Normally, second-tier lenders cost an application charge and One more price at some time of drawing down the personal loan, which is probably going being a thing you’re not used to when managing the banking institutions.

Thanks Jeff a great deal for finding our bank loan by means of below incredibly difficult and hoping moments with pop over to this site no fuss and responsive professionalism second to none.

In distinction, a non Lender lender involves merely a 10% deposit – this means you call for only 50 percent or a 3rd in the deposit amount that a Lender calls for.

Being aware of I wouldn’t manage to obtain a mortgage loan from a financial institution resulting from situation approached ILender for assistance. They were being amazing to cope with and communicated with me The entire way by.

To this point I've made use of Credible two times. The 1st time I obtained a major notched Personal Loan which I used to pay off ALL of my higher curiosity credit cards. I then ...

One of many eye-catching features from the VA mortgage plan is the fact that a down payment is just not essential. Even so, this does not imply that the qualifying veteran is not really permitted to come up with a deposit.

When lenders Continued evaluate your mortgage application, they would like to see that you could find the money for to repay your loan. Some lenders Possess a bare minimum demanded income, while others don’t — but in either situation, you’ll probably have to offer evidence of profits.

Not known Details About mortgage broker reviews melbourne

Variable house personal loan – When the fascination fee is topic to industry fluctuation, as influenced through the Reserve Bank of Australia’s dollars fee plus the lender’s preferences.

Their conversation has been excellent. Greg has delivered very handy advice along the way generally built time to listen and reply to all of my queries. They've also served be sure that all information are in place for a smooth settlement. I can be pleased to suggest their services to family and friends.

There wasn't query also foolish or as well really hard that together with his comprehensive practical experience and knowledge he was unable to reply confidently and manufactured us truly feel at ease working with Mortgage Corp. Almost everything was managed swiftly, successfully and his customer support is the greatest that We have now stumble upon. Many thanks Neil for encouraging improve our lives.”

There are several challenges and hurdles a single must confront on the path to An effective house acquire and who superior to contact on for assist than a home owner, investor and qualified Expert.

I couldn't be happier with Neil and would extremely advocate his products and services to any future residence customer.”

Find out how a Sydney-based mortgage broker will let you get the most beneficial dwelling bank loan in your case, even if your lender has rejected your application.

We're a boutique Finance Broker located in Melbourne, supplying a holistic approach to various finance alternatives. We know that Everybody’s economical situation differs so we take some time to center on getting the ideal outcome according to your unique economic situations.

Please Notice that the information released on our web site really should not be construed as particular tips and does not take into consideration your personal demands and situation. Although our web page will offer you factual info and typical suggestions that will help you make superior conclusions, it's not a substitute for Expert tips.

“Just needed to move on my Specific due to the Entourage crew for your optimistic experience having a latest property invest in and sale.

Where our internet site links to unique products or shows 'Drop by view publisher site internet site' buttons, we may receive a Fee, referral price or payment when you click Individuals buttons or apply for a product. You can find out more about how we generate income.

For those who are searhing for a quick turnaround, search elsewhere; time moves at a unique speed on Earth MBM. I squandered eleven times with two various brokers and gave up. Working with a way more productive broker now.

But what When you have anyone by your aspect who understands the ins and outs on the property sector and foreseeable future financial ambitions?

Customers Fiona and Sam Hurst a short while ago obtained their to start with house – “whenever we to start with ended up trying to buy our household we experienced no clue the way it all labored and Austin and his team created us really feel look at this now relaxed with everything and helped us into our initial residence. Couldn’t be far more grateful.”

Scott has Individually owned and invested in many Houses Our site over the past 3 many years and enjoys sharing his serious-globe experiences together with his consumers that will help them reach their assets dreams and aspirations.

All About Mortgage

The Mortgage Ideas

Consultants would usually assist companies in preparation, often offering advice when the demand arises. They would, at times, take the lead in tasks that involve information celebration as well as interpretation of information celebration results so that they can give strong suggestions on actions that the company might embark on. They might additionally direct the organization in implementing any type of changes brought about by their working as a consultant and in reviewing the efficiency of the adjustments.

10 Simple Techniques For Mortgage Calculator

Few people have numerous thousands of bucks set aside to spend for a residence in money. Rather, the majority of individuals need to take out a home loan. If you ask your property representative, they may advise a loan provider they have a good background with. One of the biggest cash errors homeowners make is not searching for the best mortgage possible.

You might collaborate with a home mortgage broker. Here's what you need to learn about what a home loan broker does, so you can make a decision whether functioning with one will certainly be the most intelligent option for you. In this post A home loan broker functions as a 3rd event that helps connect you with home loan lending institutions.

9 Easy Facts About Refinance Explained

They usually have partnerships with a number of loan providers. This allows them to locate you a loan provider that satisfies your requirements. The mortgage broker collects all the documentation and also makes certain the mortgage process moves along through closing. Ideally, they will assist you locate the very best rate of interest as well as loan options for your situation without you having to do all the legwork.

9 Simple Techniques For Mortgage

Without a broker, you would not be able to get estimates or home mortgages from these loan providers. Without a mortgage broker, you typically have to use with each loan provider to obtain an estimate of the rate you'll receive and the costs you'll have to pay to take out a loan.

This can take a great deal of time as well as cause a whole lot of migraines. Brokers have excellent working partnerships with their lenders. They often have a rough concept of the rates a lender is using on any offered day. Brokers typically understand what closing prices to expect and what demands each loan provider they deal with has.

Facts About Mortgage Rates Uncovered

If your broker gains a payment from a lending institution, that compensation might affect which lending institution you get described (mortgage calculator). If lender A has exceptional terms but pays a low payment and also lender B has respectable but even worse terms and also pays a greater commission, the broker may refer you to loan provider B moved here to obtain a larger income.

Look for online reviews for the home loan broker you intend to use. That stated, recurring problems noted in reviews ought to make you very carefully take into consideration working with a broker - Mortgage Broker.

Rumored Buzz on Mortgage Broker

Utilizing a mortgage broker may deserve it if they can safeguard you a better home mortgage than you can find by yourself. As long as you understand how the broker is made up which settlement doesn't cause you getting an even worse home mortgage, using a broker might save you a great deal of time rate buying by yourself.

Whether it's far better to use a mortgage broker or a financial institution depends upon your specific scenarios as well as the home loan alternatives supplied by both. You can collaborate with both to see who provides a much better bargain before moving on with your home loan. In many cases, collaborating with a regional bank or cooperative credit union rather than among the large financial institutions might make feeling if they have the ability to offer a special deal or much better home mortgage prices.

What Does Mortgage Pre-qualification Do?

How? Well, the broker can conserve the debtor's time by doing the study and documentation for them. Mortgage. This means no bother with lending documents or a lengthy wait in queues to get some pointers from the lending service provider. Instead, consumers can spend even more time searching for their dream residences. Wants some help in negotiating? Below, you can leave this job to your home mortgage broker.

Home loan brokers are straight linked to convenience. see here Below you go, a mortgage broker offers a one-stop store for customers. Well, it is a procedure where the broker gets the deal with the ideal choice in the market.

The Facts About Mortgage Calculator Uncovered

In conclusion, hiring a home mortgage broker can how much will mortgage company lend me be beneficial in different ways while looking for a mortgage financing. From accessibility to a selection of car loan programs to the comfort of a one-stop shop, brokers exist to help. refinance. Also, when it involves aid with a mortgage lending, Mortgage Broker in Red Deer will be your professional assistance.

So why wait? Submit your application online and start looking for your dream home soon!.

A Biased View of Best Mortgage Broker In Melbourne

Best Mortgage Broker Melbourne Can Be Fun For Anyone

They problem the numbers and highlight the option that ideal fits their client's personal circumstance. Some likewise manage the application procedure on their client's behalf. According to Jeremy Fisher, taking care of director of Sydney-based mortgage brokers 1st Road, a home loan broker prioritises your interests most importantly else. "What a home loan broker normally does is put the client hat on as well as take a look at what is the most ideal lender or item for the client, based on their demands," he states (best mortgage broker melbourne).

They evaluate your funds as well as obtaining power, as well as after that develop a checklist of mortgage for you to choose between. Nonetheless, while they will choose options from a number of different lending institutions, they likely won't think about every one of them, as many brokers won't deal with credit suppliers unless they pay a commission.

It stands to factor that an individual who lives and breathes residence car loans ought to be able to locate a much better offer or interest price than a person that's either browsing for the very first or second time. mortgage broker melbourne cbd. As soon as you offer the eco-friendly light to among the broker's suggest house finance options, they'll fill out all the kinds needed to obtain your finance pre-approved with that said lender.

The 9-Minute Rule for Best Mortgage Broker In Melbourne

As they will be at discomforts to mention, the majority of brokers are independent, suggesting they do not favour any kind of one loan provider, and will certainly seek the ideal possible deal or price from the loads of lenders with whom they're approved. "Regardless of whether they help a franchise group or a smaller sized organization, they're independent from a particular loan provider," Fisher states.

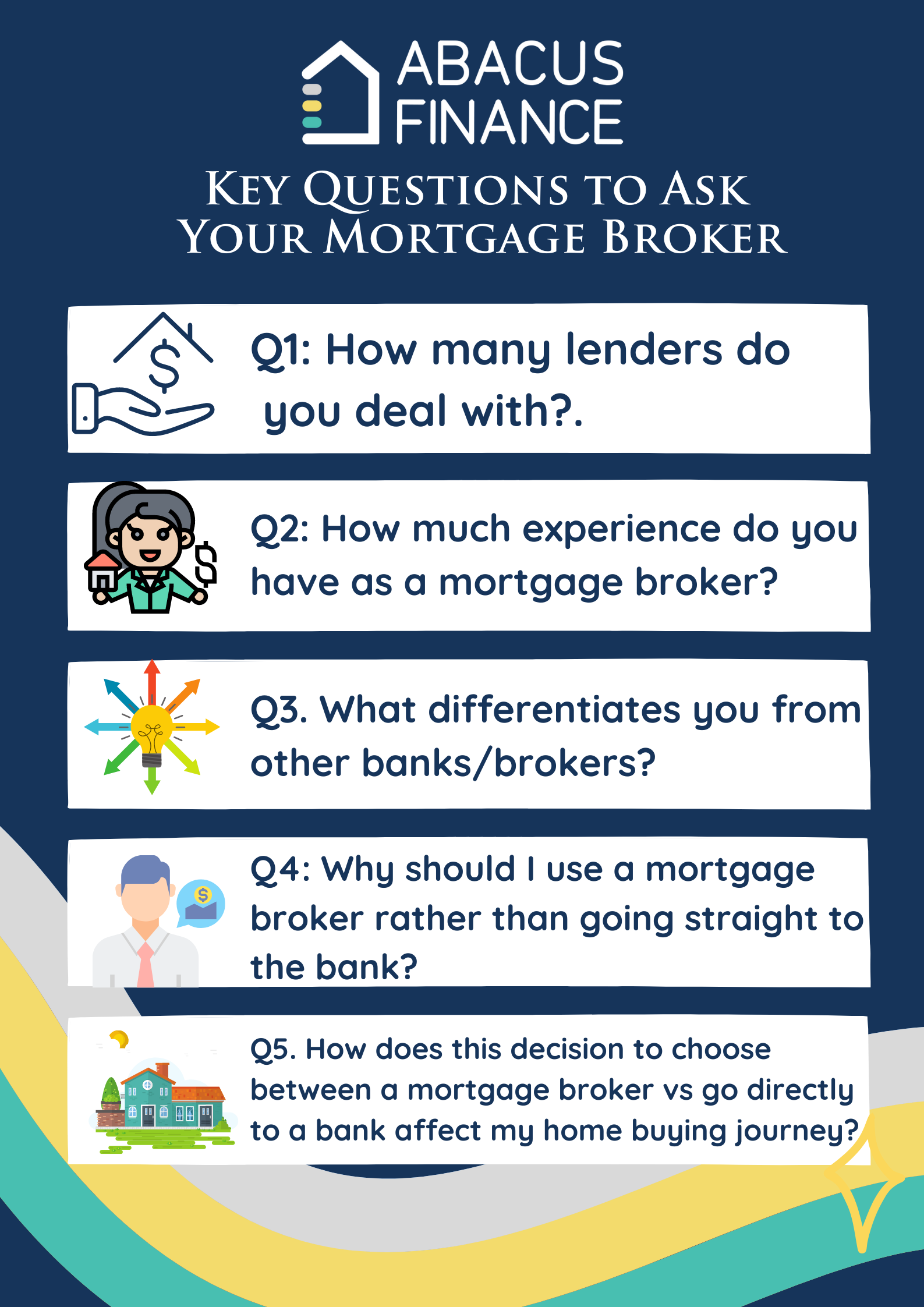

Subscription to well-regarded sector organizations is an included perk. Ask good friends or family members for referrals, as they will likely give more dependable, sincere responses than online reviews or endorsements. Ask your broker just how numerous lenders they collaborate with. The greater the number, the a lot more likely they'll have the ability to discover a mortgage that benefits you.

This will certainly permit you to work out which one offers the very best deal, and will stop unwanted shocks down the track. While you get on the subject of fees, review payments, as well. If they belong to the Mortgage and also Financing Organization of Australia (MFAA), they are needed to divulge this details under the MFAA Code of Method.

The duty of a Mortgage Broker can be confusing, especially if you are a first home buyer. Skilled home loan brokers play a vital function in functioning as the liaison for you as well as offered lending institutions. It pays to be familiar with the various benefits and drawbacks of functioning with home loan brokers.

The 25-Second Trick For Mortgage Broker Melbourne

Home mortgage brokers normally do not charge you a fee for their service, but rather earn payments on financing they why not try here aid in setting up from the financial institution. They mainly obtain paid the same per financial institution, so you don't need to stress over your broker offering you prejudiced residence loan products. Home mortgage brokers will suggest home mortgage products that are lined up with your special scenario.

A lot of home loan brokers are brand-new start-ups that have not been around that lengthy. Not all home mortgage brokers are backed by a professional assistance team.

Coast Financial sticks out among all other home loan brokers as the # 1 trusted companion that property representatives are probably to recommend in Australia. It has actually been granted the very best, large independent home mortgage broker, which indicates you can trust that you're working with a broker that has the range, stamina, and experience to eliminate for the very best deal for you.

That's due to the fact that you're restricting your options to just their items which may not necessarily have the cheapest rates, most affordable costs or ideal features. The majority of financial institutions don't such as debtors that don't fit their common design. That means you might struggle to obtain approved by your bank if your scenario is in any kind of way various from the norm, consisting of: Being self-employed, on probation or an informal employee Depending on overtime, payments, change allocations or perk repayments Not being click reference an Australian person or long-term resident If you manage the home mortgage research study procedure yourself, the only way to make certain you're obtaining the best offer is to contrast the hundreds of different funding items on the marketplace.

Getting My Mortgage Broker Melbourne Cbd To Work

Most of the distinctions in offering plan are closely guarded keys and usually matter more than the easy to contrast costs and also rates. And some loan providers only lend via brokers. This is hard and also time consuming however it matters for two main factors. Initially, every time you get debt, the lending institution draws your debt report to evaluate your application.

A solitary hard questions won't bring your rating down as well much yet several applications in a short amount read this article of time can do a lot of damage, making it harder to get accepted for debt in the future. best mortgage broker melbourne. Second, the best residence funding for you is unlikely to be the one with the least expensive rate.

The Greatest Guide To Mortgage Brokers Melbourne

Some Known Factual Statements About Mortgage Broker Melbourne

Loan Broker Melbourne for Beginners

Did they have a great experience? You might even intend to ask the broker for the contact details of a few of their own clients. Given that getting a residential or commercial property is just one of the most significant financial investments that you'll ever make, study loan products yourself as well as constantly ask hard questions of your broker including what their payment rate is.

You need to never really feel like you're being pressed to authorize on to a home mortgage. As your monetary as well as individual scenario adjustments over time, whether it's due to having children, requiring to renovate or nearing retirement, you'll need a home mortgage that progresses with you.

From application, pre-approval, approval-in-principle (AIP or problem authorization) as well as negotiation, they must exist with you every action of the way and also past. If you would love to talk with one of our senior home mortgage brokers for a cost-free, no responsibility, merely call us on or finish our on-line query kind today.

Broker Melbourne Fundamentals Explained

The function of a Mortgage Broker can be confusing, especially if you are a very first house customer. refinance melbourne. Seasoned home mortgage brokers play a crucial function in acting as the intermediator for you and offered lenders. https://unicornserve.start.page/. It pays to be aware of the various benefits and drawbacks of dealing with mortgage brokers.

Mortgage brokers generally do not charge you a cost for their service, yet rather gain payments on money they aid in arranging from the financial institution. They primarily make money the very same per financial institution, so you do not need to bother with your broker offering you biased mortgage items. Home loan brokers will certainly recommend home mortgage products that are aligned with your special situation.

A great deal of mortgage brokers are new start-ups that have not been around that long. They do not have the experience and also volume that much more well established firms have. You'll require to find a broker agent with a long background of supplying value for customers, where experience and also loan provider partnerships are concerned. Not all home mortgage brokers are backed by a qualified assistance group.

What Does Melbourne Mortgage Brokers Do?

Coast Financial stands out amongst all various other mortgage brokers as the # 1 trusted partner that actual estate agents are probably to advise in Australia. It has actually been awarded the best, large independent home loan broker, which indicates you can trust that you're working with a broker that has the scale, toughness, and experience to eliminate for the finest offer for you.

If you are in the market for a home car loan, you might be thinking about making use of a mortgage broker. In Australia, mortgage brokers write more than 50% of all residence fundings.

They will negotiate with financial institutions, credit score unions as well as other credit score service providers in your place, and might be able to arrange unique packages or bargains. A mortgage broker can likewise aid you manage the procedure from application to negotiation, giving guidance in the process. A mortgage broker will do the leg work for you (melbourne mortgage brokers).

The 8-Minute Rule for Melbourne Broker

The services of a mortgage broker are typically at no price to you, as the lender pays a compensation to the broker once the funding has cleared up. This indicates that you have access to a solution to obtain the very best car loan for you without costing any type of additional - refinance broker melbourne. Much like a physician or mechanic, home mortgage brokers are specialists in their field.

As an example, if a credit history company does not pay commissions, the broker could not include their loans on the list of products they advise. Home loan brokers are forced by regulation to reveal the details of their payments with the intro of a disclosure record under the Mortgage as well go to my site as Finance Organization of Australia's National Non-mortgage consumer debt Defense Act.

Get in touch with us on today for a confidential conversation on exactly how we can help you.

Indicators on Mortgage Brokers Melbourne You Should Know

This is a minimum requirement to work as a broker in Australia and will certainly additionally assist to certify you for more research study. There are many instructional institutes that use this training course so make certain you do your study and choose an acknowledged, certified supplier. Although this is not a requirement for licensing, it is very advised that you continue your studies after finishing the Certificate IV.

Your mentor will certainly not just assist you through the first 2 years of your career however they will normally also serve as a collector, offering you accessibility to a number of lenders. There are a couple of options in Australia, consisting of the Mortgage and Money Organization of Australia (MFAA) and the Money Brokers Association of Australia (FBAA).